can you go to jail for not filing taxes

Although it is very unlikely for an individual to receive a jail sentence for. If you still refrain from paying the IRS obtains a legal claim to your property and assets lien and after that can even seize that property or garnish your wages levy.

This Is What Happens If You File Taxes Late Story Arrest Your Debt

The short answer is maybe it depends on why youre not paying your taxes.

. So there are a. In fact even an audit is highly unlikely to land you in jail. An inquiry into this can also lead to jail time if the IRS decides to take a harsher stance based on the actions.

If youre required to file a tax return and you dont file you will have committed a crime. Is It Possible to Face Jail Time for Unpaid or Unfiled Taxes. If youre not sure whether youve filed taxes in the past 10 years you can contact the IRS at 1-800-829-1040 to ask for help.

You should be filing your tax returns when they are due the IRS does not allow anyone up to two years without imposing a penalty. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. But you cant be sent to jail if.

Former IRS Agent Explains If You Can Go To Jail for Not Filing Tax Returns The Answer May Surprise. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for. But failing to pay your taxes wont actually put.

But only in extreme tax fraud scenarios. Because most tax avoidance cases are. If you dont file within three years of.

We can be reached during normal business hours at. The criminal penalties include up to one year in prison for each year you failed to file and fines up. The short answer is maybe.

How long can you go without filing a tax return. The short answer to the question of whether you can go to jail for not paying taxes is yes. Filing a Business Tax Return.

If you fail to file a tax return and arent attempting to defraud the US. The following actions can land you in jail for one to five years. A lot of people want to know if you can really go to jail for not paying your taxes.

If you have a filing requirement and fail to file the IRS may file a substitute return on your behalf. And for good reasonfailing to pay your taxes can lead to hefty fines and increased financial problems. These penalties are 75 of the tax owed.

3 Enforced Collection Actions. 2 Penalties for Failure to File. What happens if you do not file.

Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5. Can you go to jail for not filing taxes- Yes jail is a possibility if you are not filing your taxes. It is possible that you could go to jail for failing to file your taxes but it will depend on your own personal circumstances.

Filing a GST Return. The IRS will charge a penalty for failing to file taxes. If you fail to file and pay taxes youll incur both failure-to-file and failure-to-pay.

Unpaid taxes arent great from the IRSs perspective. Not being able to pay your tax bill. So lets take a deeper look at this.

What happens if I havent filed taxes in 3 years. If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping. Finally the IRS may have you jailed if you fail to file a.

4 The Statute of. This means that while you cant be put in jail for not. If you cannot afford to.

May 4 2022 Tax Compliance. Can I go to jail for not paying IRS. Beware this can happen to you.

If the IRS believes that you have committed fraud or evasion it can assess civil fraud penalties against you. File a Tax Return. Whether a person would actually go to jail for not.

There is no deadline however on the IRS for going after nonfilers and imposing civil penaltiesin addition to any taxes owed. The question can you go to jail for not filing taxes is complicated and multifaceted. By and large the most common penalties the IRS issues are fines and interest.

Can You Go To Jail For Not Paying Taxes

Can You Go To Jail For Not Paying Your Taxes Paladini Law

Can You Go To Jail For Not Paying Taxes How To Avoid Arrest For Tax Evasion

Stream Episode Can You Go To Jail For Not Paying Taxes By All Tax Expert Podcast Listen Online For Free On Soundcloud

Filing Taxes When Incarcerated How To Justice

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

Can You Go To Jail For Not Paying Taxes Accounting Tax Advisers Cpas Ltd

Late Filing Or Payment Penalties What Happens If You File Late

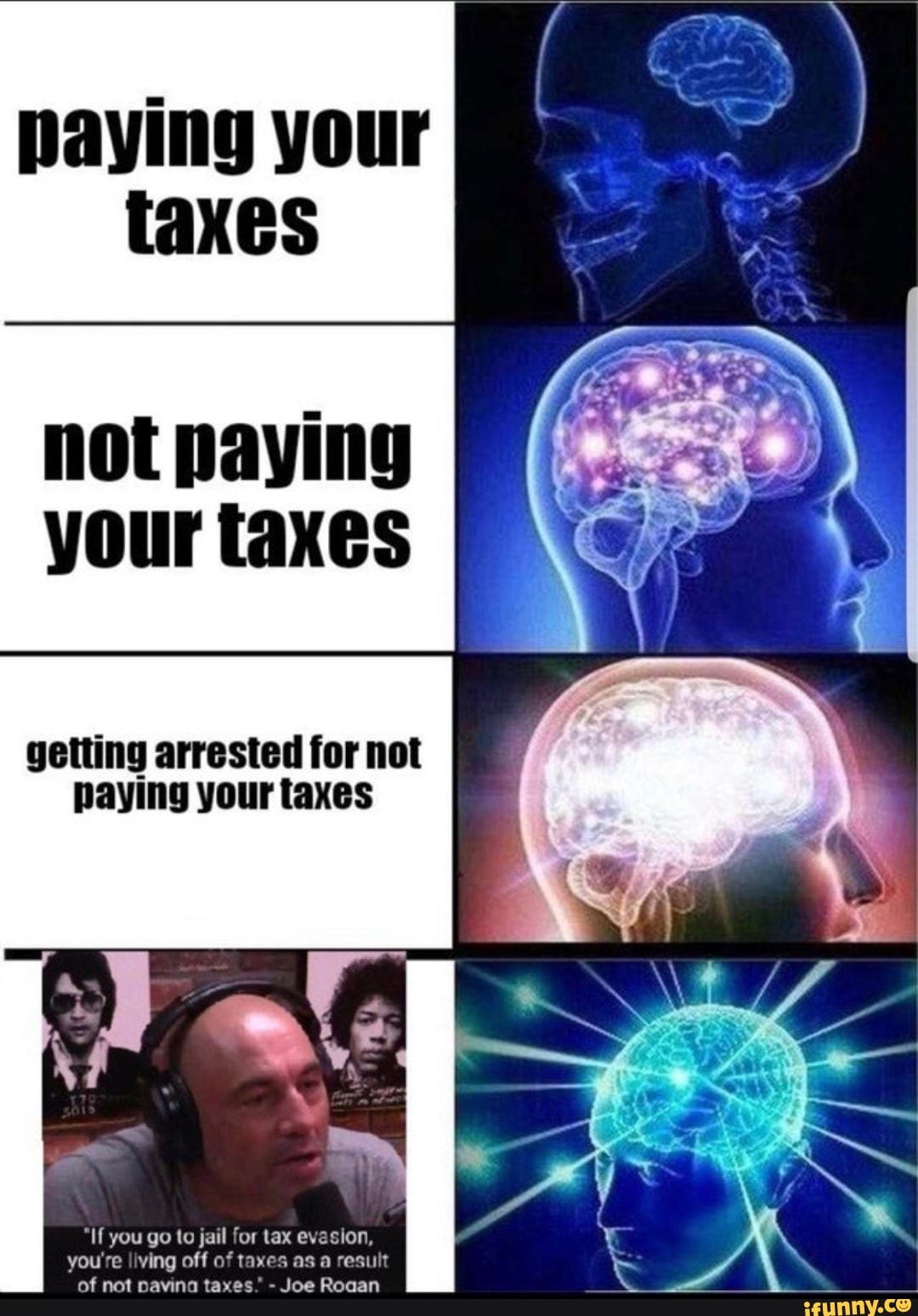

Haying Your Taxes Not Paying Your Taxes Getting Arrested For Not Naying Your Taxes Al If

What Happens If I Filed My Taxes Wrong A Complete Guide Ageras

What Could Happen If You Don T Do Your Taxes

Can You Go To Jail For Not Filing A Tax Return Damiens Law Firm 2022

Filing Taxes When Incarcerated How To Justice

Irs Notice Why The Irs Sends Notices And Letters

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Can You Go To Jail For Not Paying Taxes Our Attorney Explains